Robinhood App Reviews

For anyone entering the world of investing, Robinhood has become a household name. Known as a legendary stock trading platform, Robinhood offers a simple, mobile-friendly way to trade stocks, ETFs, options, and cryptocurrencies. With its commission-free structure and beginner-oriented interface, it has gained massive popularity. In this article, we will explore Robinhood financials, the Robinhood stock brokerage system, and provide a detailed review of the platform to help you decide if it’s the right choice for you.

What is Robinhood App ?

Robinhood App is a U.S.-based stock broker that allows users to invest in a wide range of financial instruments without paying traditional brokerage fees. Its mission is to democratize finance, making it accessible to everyone, regardless of their investment experience. The app’s interface is intuitive, mobile-first, and designed to guide beginner investors smoothly through trading.

Robinhood App also introduced fractional shares, which allow investors to purchase a portion of an expensive stock. This feature, along with commission-free trading, has positioned Robinhood as one of the most popular platforms for those just starting their financial journey.

Signing Up for Robinhood App Review

The Robinhood sign-up process is straightforward:

- You need a U.S. Social Security number or residency in a supported country.

- A linked bank account for funding your investments.

- Personal identification for verification.

After your account is approved, you can immediately start trading. There are no account minimums, making Robinhood one of the best investment apps for beginners free. The onboarding process is fast, which makes it ideal for users seeking quick access to the markets.

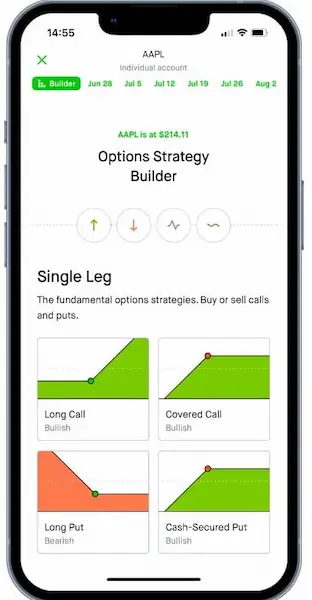

Key Features of Robinhood App

1. Commission-Free Trading

One of Robinhood’s major selling points is commission-free trading for stocks, ETFs, and options. For new investors with limited capital, this is a significant advantage. Robinhood also supports recurring investments, allowing users to build a portfolio gradually.

2. Beginner-Friendly Interface

The Robinhood finance app is designed with simplicity in mind. Users can quickly track Robinhood stock prices, monitor portfolio performance, and execute trades with just a few taps. While the simplicity is ideal for beginners, more advanced traders may find the research tools somewhat basic.

3. Cryptocurrency Trading

Robinhood App also allows trading of major cryptocurrencies, letting users manage Robinhood financial assets alongside traditional investments. Although convenient, it has limitations: transferring crypto out of the platform is restricted compared to specialized wallets.

4. Retirement Accounts

Robinhood offers IRA accounts, including traditional and Roth IRAs. This feature helps beginner investors start planning for retirement early while keeping everything in one app.

5. Fractional Shares and Recurring Investments

The ability to invest in fractional App shares and automate purchases through recurring investments allows users to grow their portfolio steadily. This is especially useful for beginners who don’t have large sums to invest initially.

Pros of Robinhood App

- Zero commissions and no account minimums

- Fractional share investing

- Mobile-first, intuitive interface

- After-hours trading for flexibility

- IRA accounts for retirement planning

- Recurring investments to encourage disciplined investing

Because of these features, Robinhood App is often included in lists of the top 10 trading platforms for beginner investors.

Cons and Limitations

Despite its popularity, Robinhood has some limitations:

- Limited asset classes: no mutual funds, bonds, or forex.

- Basic research tools: limited compared to other brokers.

- Customer support: mainly email-based and can be slow.

- Regional restrictions: primarily available to U.S. residents.

- Encourages speculation: its simple interface can make trading feel like a game.

It’s important for users to recognize that Robinhood is most suitable for beginners experimenting with small investments rather than long-term wealth-building.

Robinhood App Financials and Performance

Robinhood financials have been widely discussed in the media, particularly regarding its revenue from payment-for-order-flow, which has sparked debate over trade execution quality. Despite occasional controversies, the platform maintains a strong user base, highlighting its effectiveness in providing accessible investing options.

Tracking Robinhood App stock performance is simple, with the app providing up-to-date Robinhood bourse data, analyst ratings, and market news. This helps investors make informed decisions, even though the platform’s research tools are limited compared to full-service brokers.

Who Should Use Robinhood?

Ideal Users:

- New investors and beginners

- People with small investment capital

- Users seeking a simple, mobile-first stock brokerage

- Individuals interested in stocks, ETFs, options, and crypto

- Investors looking for commission-free trading and fractional shares

Users Who May Avoid It:

- Advanced traders needing comprehensive research and analytics

- Investors seeking diversified portfolios with bonds, mutual funds, or global assets

- Users outside the U.S. or unsupported regions

- People who need dedicated, fast customer support

Robinhood Compared to Other Stock Brokers

Among Robinhood app stock brokers, Robinhood stands out for its simplicity and ease of use. Platforms like E*TRADE or TD Ameritrade offer more research tools and asset options but are often overwhelming for beginners. This makes Robinhood ideal for casual investors looking for an easy start.

The app is sometimes referred to as a Robinhood legend in fintech circles because it has reshaped the way beginners approach investing by removing entry barriers and lowering costs.

Safety and Security

Robinhood is SIPC insured, meaning your securities are protected up to $500,000. The app uses encryption and secure authentication to safeguard accounts. However, users should remember that investment risks remain, particularly with options and cryptocurrencies.

Robinhood Stock Brokerage Insights

The Robinhood stock brokerage system provides:

- Real-time market updates

- Access to fractional shares

- After-hours trading

- A mobile-first trading experience

These features make it convenient for beginners to learn and grow in the stock market while keeping costs low.

Conclusion

Robinhood App is a standout platform for beginner investors seeking a free, user-friendly, mobile-first stock trading app. Its strengths include commission-free trading, fractional shares, retirement accounts, and recurring investment options. However, limitations such as restricted asset classes, basic analytics, and regional availability mean it may not suit advanced or international investors.

For anyone starting out in investing, particularly in stocks, ETFs, or crypto, Robinhood remains one of the best stock trading apps for beginners. Its focus on accessibility and simplicity has earned it a reputation as a Robinhood legend in the world of online finance.